ACT 60

Act 60 of 2019, also known as the “Code of Incentives”, became a law on July 1, 2019, to gather and measure the return on investment of the Puerto Rico tax incentives acts available currently, including Acts 20 and 22 of 2012. Although it brought various changes to these Acts, applicants have the option of applying and be grandfathered under Acts 20 and 22 if they apply by December 31, 2019. Therefore, applications after January 1, 2020, will be fully subject to the provisions of Act 60 of 2019.

Puerto Rico Incentives Code Act: An economic development tool based on fiscal responsibility, transparency and ease of doing business

In order to promote the necessary conditions to attract investment from industries, support small and medium merchants, face challenges in medical care and education, simplify processes, optimize and provide greater transparency, Act 60-2019 was signed, which establishes the new Puerto Rico Incentives Code.

Puerto Rico Incentives Code Act: An economic development tool based on fiscal responsibility, transparency and ease of doing business. In order to promote the necessary conditions to attract investment from industries, support small and medium merchants, face challenges in medical care and education, simplify processes, optimize and provide greater transparency, Act 60-2019 was signed, which establishes the new Puerto Rico Incentives Code. Its main objective is to promote economic development on our island. It provides certainty related to the types of incentives that Puerto Rico offers to attract investment and create jobs in very important and traditional sectors such as manufacturing, tourism and agriculture; as well as aerospace, biosciences, technology, renewable energy, entrepreneurship and export services. In addition, it defines new incentives to support emerging sectors, such as the creative, eSports and entertainment industries. And it is based on metrics that will measure its effectiveness and the return on investment of all the incentives granted.

One of the benefits of Act 60-2019 is that it consolidates in one place dozens of previously approved incentive Acts, harmonizing and standardizing as much as possible, tax incentives applied to income, royalties, dividends and distribution of interest, and profits from capital. It also adjusts municipal contributions to provide more participation to municipalities and increase their capacity to generate income, while maintaining a competitive level and the certainty required to attract investment. Furthermore, the small and medium businesses eligible under this Act, as well as exempt companies with operations in Vieques and Culebra, could receive additional tax incentives during the first five years of operation; and new incentives are added. This new tool will be an important component to promote job creation, investment in strategic sectors, innovation, exports, talent retention, international competitiveness and economic development of Puerto Rico. All changes are forward looking and do not apply to existing incentive contracts.

MAIN CHANGES BROUGHT BY ACT 60 OF 2019, ALSO KNOWN AS THE CODE OF INCENTIVES, TO ACTS 20 AND 22 OF 2012:

Main changes to Act 20 of 2012:

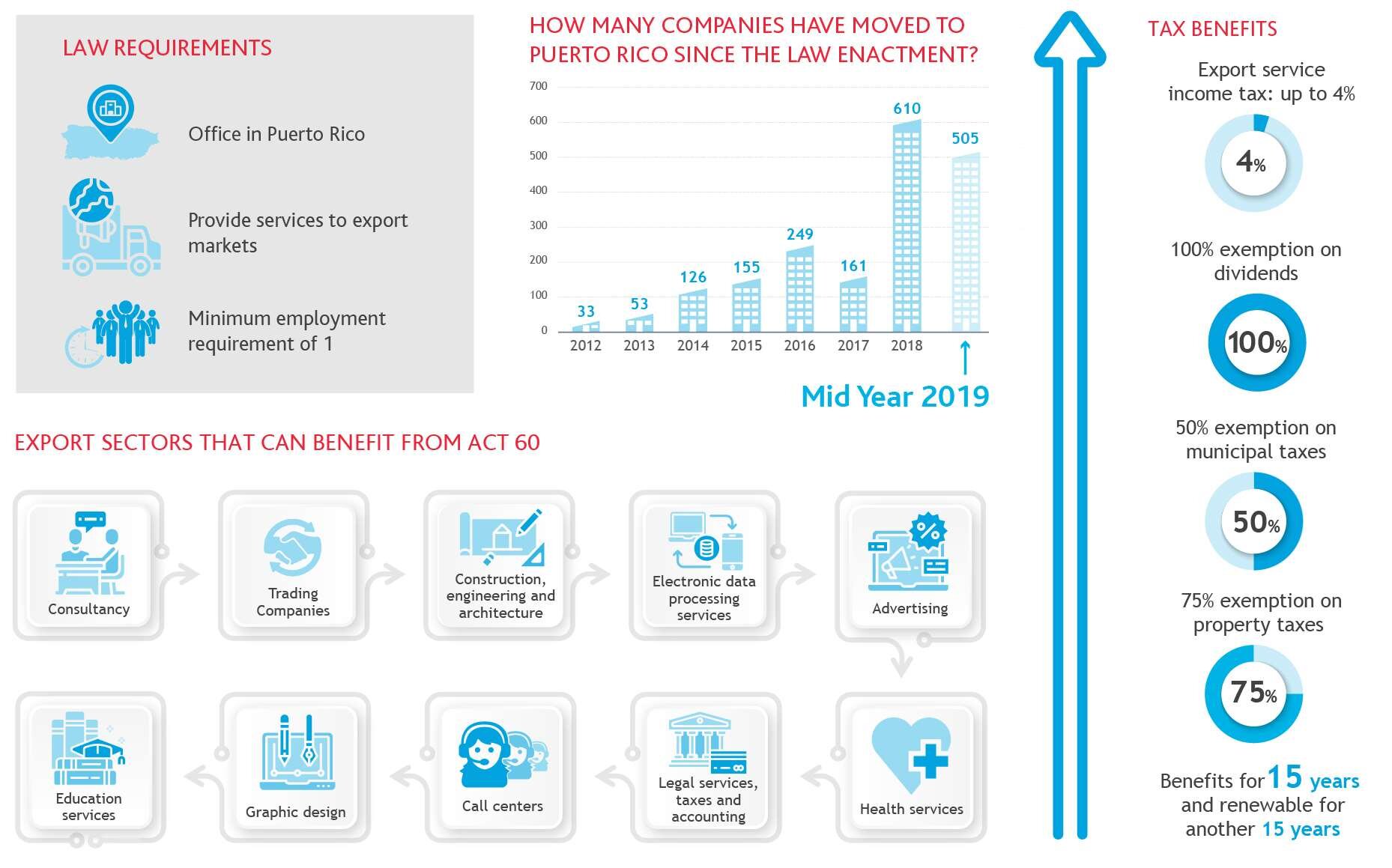

Act 20New Code of Incentives (Act 60)60% exemption on municipal license taxes50% exemption on municipal license taxes.90% exemption on real and personal property taxes on property used in the Act 20 business75% exemption on real and personal property taxes on property used for the export, promotion, and or trade services.No employee requirementOne (1) employee required if the company’s projected or actual volume of business exceeds three million ($3,000,000)20-year decree term, renewable for 10 years15-year decree term, renewable for 15 years.

Main changes to Act 22 of 2012:

Act 22New Code of Incentives (Act 60)Individual should not have been a resident of PR six (6) years prior to January 17, 2012.Individual should not have been a resident of PR ten (10) years prior to July 1, 2019.Annual $5,000 contribution to a certified 1101.01 PR nonprofit organizationAnnual $10,000 contribution to a certified 1101.01 PR nonprofit organization. $5,000 has to be donated to a nonprofit that works with the eradication of child poverty and that is listed in the annual legislative funds list released by the Joint Special Commission of Legislative Funds for Community Impact.No residential property purchase requirementPurchase required within 2 years after the effectiveness of the Grant. Must be purchased from an unrelated person and be of exclusive domain and residential use. Can be purchased as a sole owner or jointly with a spouse.No definition on “Securities” or on “Other Assets”Definitions are now created and capital gain exemptions are applicable to: “Securities”, which means any note, bond, promissory note, debt evidence, options, futures contracts, forward contracts, stock, and any other similar instrument or with similar characteristics, including derivative instruments adopted by circular letter, administrative determination, regulation or any other pronouncement made jointly by the Secretary of DEDC and the Secretary of Treasury. “Other Assets” means commodities, coins, and digital assets based on blockchain technology.Decree effective until December 31, 203515-year decree term, renewable for 15 years.

Promote Exportation of Services

INCENTIVES FOR EXPORT SERVICES

4% Income Tax Rate

Eligible businesses providing services for exportation will enjoy a 4% flat income tax rate on net income related to such services

100% Tax-Exempt Dividends

Distributions from earnings and profits derived from the export services income of eligible businesses are 100% tax exempt from Puerto Rico income taxes

50% Exemption on Municipal Taxes

Municipalities in Puerto Rico may levy a gross receipts tax of up to 0.5% (1.5% for financial services)

75% Exemption on Property Taxes

Property used in eligible export activities will enjoy a 75% exemption

TAX EXEMPTION DECREE

To enjoy the benefits granted under the Incentives Code the Eligible Business must request and obtain a tax exemption decree under Act 60, which will be signed by the Secretary of the Department of Economic Development and Commerce of Puerto Rico.

Such decree will have a term of 15 years, renewable for 15 additional years, provided certain conditions are satisfied.

The Tax Exemption Decree will constitute a contract with the Puerto Rico Government not subject to subsequent legislative changes.

There is a minimum employment requirement of at least 1 employee if annual business volume is greater than $3,000,000.

WHY IS PUERTO RICO THE PERFECT DESTINATION FOR BUSINESSES?

To promote Relocation of Investors

Act 60 of 2019 known as the Tax Incentives Code of Puerto Rico (“Incentives Code”) offers the tax incentives formerly granted under Act 22 of 2012 to individual investors that relocate to Puerto Rico. Act 60 includes incentives to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on passive income accrued after such individuals become New Residents of Puerto Rico.

INCENTIVES FOR INDIVIDUAL INVESTORS

100% Tax Exemption on Dividends and Interest

New Residents will enjoy a 100% tax exemption from Puerto Rico income taxes on all dividend and interest income

Interest and dividends that qualify as Puerto Rico source income will not be subject to federal income taxation under Section 933 of the U.S. Tax Code

100% Tax Exemption on Capital Gains from Securities and Digital Assets (“Eligible Investments”)

All capital gains accrued from Eligible Investments after becoming a New Resident will be 100% exempt from Puerto Rico Income taxes

Capital gains and other investment income sourced to Puerto Rico will not be subject to federal income taxes

Prior Unrealized Capital Gains: Capital gains accrued prior to becoming a New Resident and realized after moving to Puerto Rico may be subject to tax

To qualify for the Act 60 incentives, all gains must be recognized prior to January 1, 2036

ELIGIBILITY

To qualify under Act 60 an individual must have physical presence in the Island for at least 183 days of the year and must not have been a resident of Puerto Rico from 2009 to 2019 (the 10-year period preceding the effective date of the Incentives Code).

TAX EXEMPTION DECREE

Individual investors who want to enjoy the benefits granted under the Incentives Code must apply for and obtain a tax exemption decree under Act 60, which will be signed by the Secretary of the Department of Economic Development and Commerce of Puerto Rico.

The Tax Exemption Decree will constitute a contract with the Puerto Rico Government not subject to subsequent legislative changes.

REQUIREMENTS

To obtain access to the approved and signed Tax Exemption Decree under Act 60, a one-time fee of $5,000 must be satisfied and deposited into the 'Special Fund under the Act to Promote the Transfer of Individual Investors to Puerto Rico'.

All Individual Investors that hold a Tax Exemption Decree under Act 60 must comply with an annual contribution of $10,000 to a duly organized and registered non-profit organization in Puerto Rico.

A residential property must be purchased in Puerto Rico within the first two years after obtaining the decree.

WHY IS PUERTO RICO AN IDEAL INVESTMENT DESTINATION?

Have any questions? Feel free to ask. we can connect you to trusted a local expert in any area of the island. & of course if you need help with anything thats Real Estate related we are always here at your disposal.